Suzhou Thvow Technology Co Ltd: Riding the Winds of Change

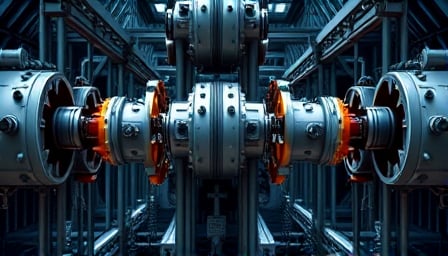

In the bustling industrial landscape of China’s Zhangjiagang province, Suzhou Thvow Technology Co Ltd stands as a beacon of innovation and resilience. Specializing in engineering services, the company has carved a niche for itself in power engineering, clean energy engineering, and the manufacturing of pressure vessel products. Listed on the Shenzhen Stock Exchange, Suzhou Thvow Technology has been navigating the ebbs and flows of the market with a strategic focus on sustainable energy solutions.

Recently, the company has witnessed significant price fluctuations, capturing the attention of investors and analysts alike. The stock has seen a notable increase, driven by the burgeoning demand for wind energy-related stocks. This surge is reflective of a broader market trend, where clean energy solutions are increasingly becoming a focal point for investment. Suzhou Thvow Technology’s stock performance is a testament to its strategic positioning in this growing sector.

The company’s financial performance in the first quarter of 2025 has been particularly impressive. It reported a 23.83% year-over-year increase in net profit, underscoring its robust operational capabilities and market adaptability. This growth in profitability highlights the company’s successful execution of its business strategies and its ability to capitalize on market opportunities.

However, not all financial indicators have been positive. The company’s operating cash flow has seen a decline, which could be a point of concern for stakeholders. This decrease suggests that while the company is profitable, it may be facing challenges in converting its earnings into cash. Additionally, Suzhou Thvow Technology has managed to significantly reduce its short-term borrowings, indicating a strategic move towards strengthening its financial position and reducing reliance on debt.

The company’s market capitalization stands at 4.1 billion CNH, reflecting its substantial presence in the market. However, this has also led to a relatively high price-to-earnings ratio of 2.4, suggesting that investors are willing to pay a premium for its shares, possibly due to its promising growth prospects in the clean energy sector.

As Suzhou Thvow Technology continues to navigate the dynamic landscape of the industrial and machinery sectors, its focus on clean energy and engineering services positions it well for future growth. With its strategic initiatives and market adaptability, the company is poised to harness the winds of change and continue its upward trajectory in the years to come. For more information on Suzhou Thvow Technology and its offerings, interested parties can visit their website at www.thvow.com .