Sylvania Platinum Ltd: A Strong Year Ahead

In a remarkable display of resilience and strategic foresight, Sylvania Platinum Ltd, a South African company specializing in platinum group metals (PGMs), has once again revised its full-year output guidance upwards. This announcement, made on April 30, 2025, underscores the company’s robust operational performance and its adept navigation of the volatile metals and mining sector.

Operational Highlights and Financial Health

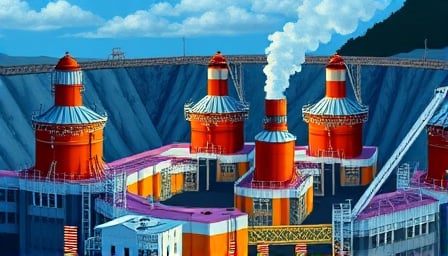

Sylvania Platinum, listed on the London Stock Exchange, operates within the Bushveld Igneous Complex, focusing on the retrieval of mine tailings and the operation of shallow mines. This strategic positioning allows the company to capitalize on the rich platinum group metals deposits in South Africa. As of April 28, 2025, the company’s shares were trading at GBP 46.9, reflecting a strong market presence with a market capitalization of GBP 156.8 million.

Financially, Sylvania Platinum has demonstrated solid fundamentals. The company boasts a price-to-earnings ratio of 14.81, indicating a healthy valuation relative to its earnings. Furthermore, its liquidity and solvency ratios, including a quick ratio of 15.92 and a current ratio of 9.94, highlight the company’s strong financial health and its ability to meet short-term obligations.

Market Movements and Investor Sentiment

Despite a recent dip below its two hundred-day moving average, trading at GBP 46.50, Sylvania Platinum’s shares have shown resilience, closing at GBP 48 with a trading volume of 296,295 shares. This movement reflects a temporary setback in an otherwise upward trajectory, with the company’s shares trading close to their 52-week high of GBP 73. The recent adjustment in output guidance is likely to bolster investor confidence, potentially reversing the short-term bearish sentiment.

Strategic Developments and Future Outlook

The company’s strategic initiatives, including the exploration and development of new mining sites, are pivotal to its growth strategy. The recent agreement to extract gold at the Peninsula Prospect and the sale of the Deadman Flat & Perry Creek Project to Capricorn Metals Ltd for up to $3.75 million plus a net smelter return (NSR) royalty, are testament to Sylvania Platinum’s proactive approach to diversifying its portfolio and enhancing shareholder value.

Looking ahead, Sylvania Platinum’s revised output guidance is a clear indicator of the company’s confidence in its operational capabilities and its strategic direction. With a focus on expanding its exploration activities and optimizing its existing operations, Sylvania Platinum is well-positioned to capitalize on the growing demand for platinum group metals, driven by the global shift towards sustainable energy solutions.

Conclusion

Sylvania Platinum Ltd’s recent announcement of increased full-year output guidance is a significant milestone, reflecting the company’s operational excellence and strategic foresight. With strong financial fundamentals, a proactive approach to exploration and development, and a clear focus on sustainability, Sylvania Platinum is poised for continued success in the dynamic metals and mining sector. Investors and industry observers alike will be keenly watching the company’s progress in the coming months, as it seeks to further solidify its position as a leading player in the platinum group metals market.