Syrma SGS Technology Ltd: A Surge in the Electronic Manufacturing Services Sector

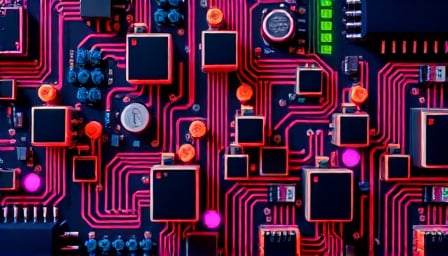

In a remarkable week for Syrma SGS Technology Ltd, the India-based electronic manufacturing services company has seen its shares soar, driven by strategic developments and positive market sentiment. The company, listed on the National Stock Exchange of India, specializes in manufacturing electronic sub-assemblies, assemblies, and a range of other electronic products, including RFID and MedTech devices.

JPMorgan’s Bullish Outlook

The week began with JPMorgan initiating coverage for Syrma SGS Technology, assigning an Overweight rating and highlighting a 30% potential upside. This endorsement underscores the firm’s confidence in the company’s growth trajectory and its position within the burgeoning electronic manufacturing services (EMS) sector. JPMorgan’s analysis points to the EMS sector as a ‘sunrise sector,’ with Syrma SGS Technology leading the pack alongside other notable companies.

Record-Breaking Share Performance

Syrma SGS Technology’s shares have been on a remarkable upward trajectory, hitting a 52-week high of ₹682.7 per share. Over just two days, the stock surged nearly 10%, reflecting investor enthusiasm and confidence in the company’s strategic initiatives. This rally was fueled by reports of Syrma SGS Technology’s plans to establish India’s largest multi-layer Printed Circuit Board (PCB) and Copper Clad Laminate (CCL) manufacturing facility in Andhra Pradesh, a move that promises to significantly bolster the company’s manufacturing capabilities and market position.

Strategic Expansion in Andhra Pradesh

The decision to set up the largest PCB and CCL manufacturing facility in Naidupeta, Andhra Pradesh, marks a significant milestone for Syrma SGS Technology. This expansion is not just a testament to the company’s growth ambitions but also a strategic move to strengthen India’s electronics supply chain. The facility is expected to enhance Syrma SGS Technology’s production capacity and efficiency, further solidifying its leadership in the EMS sector.

Market and Sector Implications

The developments surrounding Syrma SGS Technology have broader implications for the EMS sector and the Indian economy. As JPMorgan highlights, the EMS sector is emerging as a key growth area, driven by increasing demand for electronic products and services. Syrma SGS Technology’s strategic initiatives and the positive market response underscore the sector’s potential and the opportunities it presents for investors.

Conclusion

Syrma SGS Technology Ltd’s recent achievements and strategic developments have positioned it as a leader in the electronic manufacturing services sector. With strong backing from JPMorgan and a clear growth trajectory, the company is well-placed to capitalize on the opportunities in the EMS sector. As it continues to expand its manufacturing capabilities and market reach, Syrma SGS Technology is set to play a pivotal role in shaping the future of India’s electronics industry.