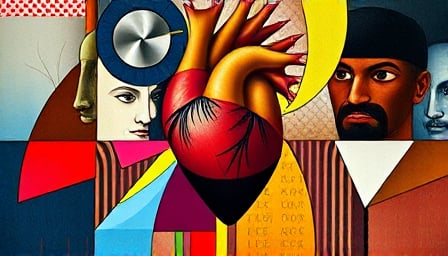

Tenaya Therapeutics Inc: A Beacon of Hope or a Market Mirage?

In the bustling heart of San Francisco, a biotechnology company named Tenaya Theratics, Inc. stands at the forefront of a noble mission: to revolutionize the treatment of heart disease by targeting its underlying causes. With a vision to deliver curative therapies, Tenaya Therapeutics aims to transform patient outcomes and redefine health standards across the United States. However, beneath the surface of this ambitious endeavor lies a financial narrative that raises eyebrows and questions alike.

A Nasdaq Journey: From Peaks to Valleys

Listed on the Nasdaq, Tenaya Therapeutics has experienced a rollercoaster ride in the stock market. The company’s shares once soared to a 52-week high of $4.01 on December 9, 2024, painting a picture of investor confidence and market optimism. Yet, the landscape shifted dramatically, with the stock plummeting to a 52-week low of $0.36 by May 14, 2025. As of August 4, 2025, the closing price stood at a modest $0.695, a stark reminder of the volatility that characterizes the biotech sector.

Financial Metrics: A Closer Look

With a market capitalization of approximately $109.96 million, Tenaya Therapeutics finds itself in a precarious position. The company’s price-to-earnings (P/E) ratio of -0.603 is particularly telling, signaling that the company is not currently profitable. This negative P/E ratio is a red flag for investors, suggesting that the company’s earnings are either negative or not yet realized, despite its lofty ambitions.

The Mission: A Noble Cause Amidst Financial Uncertainty

At its core, Tenaya Therapeutics is driven by a mission to combat heart disease, a leading cause of death worldwide. By focusing on the root causes of this pervasive ailment, the company aspires to deliver groundbreaking therapies that could potentially save millions of lives. This mission, while commendable, is fraught with challenges, not least of which is the financial instability reflected in its stock performance.

Investor Sentiment: Hope or Hype?

The dramatic fluctuations in Tenaya Therapeutics’ stock price raise critical questions about investor sentiment. Is the company’s mission enough to sustain long-term investment, or is it merely a speculative bubble waiting to burst? The biotech industry is known for its high-risk, high-reward nature, and Tenaya Therapeutics is no exception. Investors must weigh the potential for groundbreaking medical advancements against the stark reality of financial metrics that suggest caution.

Conclusion: A Critical Perspective

Tenaya Therapeutics, Inc. stands at a crossroads, embodying both the promise of medical innovation and the perils of financial volatility. As the company continues its quest to revolutionize heart disease treatment, it must navigate the treacherous waters of investor expectations and market dynamics. For those considering an investment, the question remains: Is Tenaya Therapeutics a beacon of hope in the fight against heart disease, or is it a market mirage, shimmering with potential yet grounded in financial uncertainty? Only time will tell.