Terra Clean Energy Corp. Secures 100 % Interest in 75 Formerly Producing Uranium Claims in Utah

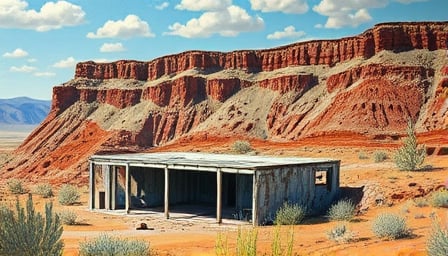

Terra Clean Energy Corp. (CSE: TCEC, OTCQB: TCEFF, FWB: C9O0) announced on 17 September 2025 that it has entered into an agreement to acquire up to a 100 % interest in 75 uranium claims located in Emery County, Utah. The transaction expands the company’s portfolio into a risk‑controlled uranium project situated within the San Rafael Swell, a region that has historically produced high‑grade uranium ore.

Transaction Highlights

| Item | Detail |

|---|---|

| Number of Claims | 75 former producing uranium claims |

| Location | Emery County, Utah, USA (San Rafael Swell) |

| Ore Grade | Up to 1 % U₃O₈ |

| Estimated Proven Reserves | Several hundred thousand tonnes of ore |

| Strategic Rationale | Diversification into a low‑risk uranium project; addition to a portfolio of resource‑intensive assets |

| Shareholder Impact | Acquisition of a 100 % interest, providing full control and potential for downstream development |

The claims were previously the site of nine operating uranium mines that collectively extracted large quantities of ore at grades approaching one percent uranium pentoxide (U₃O₈). By securing full ownership, Terra Clean Energy positions itself to benefit from any future exploration or development activities without the constraints of joint‑venture structures or royalty obligations.

Market Context

The announcement coincided with the resumption of trading for Terra Clean Energy on multiple platforms, including the Canadian National Stock Exchange and the OTCQB market. Trading had been temporarily suspended earlier on 16 September 2025 (as noted in the Finanznachrichten and ceo.ca releases), with the resumption effective 17 September 2025. The brief suspension and subsequent resumption underscore the market’s attention to the company’s evolving asset base.

Implications for Investors

Terra Clean Energy is a junior exploration firm that focuses on identifying, acquiring, exploring, and evaluating mineral resource properties across North America. Its market capitalization, as of the close on 16 September 2025, stood at CAD 5,450,171, reflecting the high‑growth potential typical of junior mining and exploration companies. The new uranium asset adds a tangible, historically productive resource that may enhance the company’s valuation, particularly in a market increasingly attentive to nuclear fuel supply chains.

Forward‑Looking Statements

While the acquisition represents a strategic advancement, the company acknowledges that further work—geological assessment, environmental review, and regulatory approvals—will be necessary to determine the full economic viability of the uranium claims. Terra Clean Energy cautions that actual production, market prices, and future costs could differ materially from expectations.

The acquisition marks a significant milestone for Terra Clean Energy, expanding its footprint into a well‑established uranium region and providing a potential source of revenue growth while maintaining a risk‑controlled exposure to the uranium market.