Texas Instruments Incorporated, a leading entity in the semiconductor design and manufacturing sector, has recently demonstrated a stable performance in the stock market. As of the latest trading day, November 6, 2025, the company’s stock closed at $160.55. This figure situates the stock approximately midway between its 52-week low of $139.95, recorded on April 10, and its 52-week high of $221.69, observed on July 10.

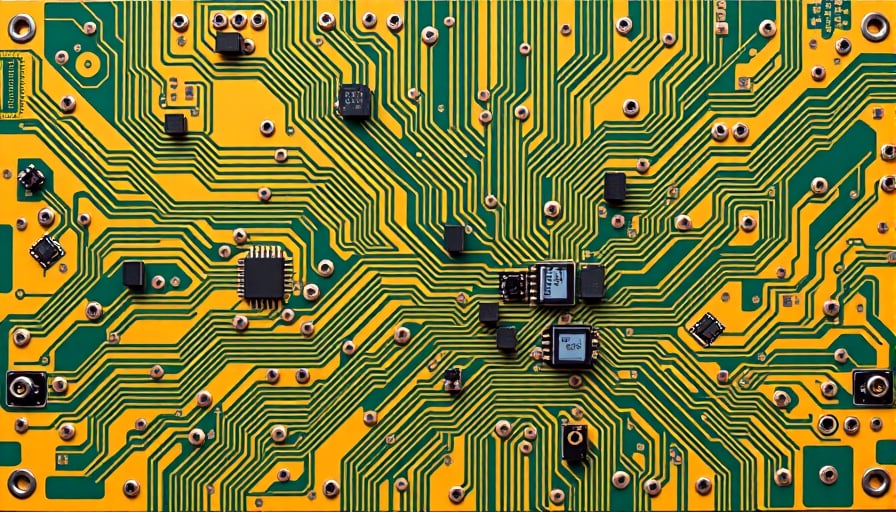

Operating within the Information Technology sector, specifically in the Semiconductors & Semiconductor Equipment industry, Texas Instruments continues to be a pivotal player globally. The company’s focus on the development of analog integrated circuits (ICs) and embedded processors underscores its commitment to innovation and technological advancement. This strategic emphasis not only caters to a diverse range of industries but also reinforces its position as a key supplier of semiconductor solutions worldwide.

The company’s market capitalization stands at approximately $145.88 billion, reflecting its substantial presence and influence in the global market. Despite the absence of new corporate announcements since a Forbes article on November 3, which questioned the stock’s valuation, Texas Instruments maintains a robust financial profile. The stock’s price-to-earnings ratio of 29.73 indicates a moderately high earnings yield, suggesting investor confidence in the company’s future growth prospects. Additionally, the price-to-book ratio of 8.78 further highlights the market’s valuation of the company’s assets and potential.

Texas Instruments’ stock trajectory over the past year has been characterized by stability, with a steady appreciation from its annual low. This trend suggests a resilient market position, even as the stock has not yet reached its historical peak. The company’s ability to maintain a consistent performance amidst market fluctuations is indicative of its strong operational foundation and strategic foresight.

As a Nasdaq-traded entity, Texas Instruments continues to engage with investors and stakeholders through its transparent communication and strategic initiatives. For those interested in exploring the company’s offerings and future directions, further information is available on their official website at www.ti.com .

In summary, Texas Instruments Incorporated remains a formidable force in the semiconductor industry, with a stable stock performance and a strategic focus on innovation. The company’s financial metrics and market position suggest a promising outlook, reinforcing its role as a key player in the global technology landscape.