TEYI Pharmaceutical Group Co Ltd amid a Surge in China’s Healthcare and Chemical Sectors

TEYI Pharmaceutical Group Co Ltd, a leading developer and manufacturer of traditional Chinese medicine and chemical agents headquartered in Taishan, China, has found itself positioned at the intersection of two powerful market dynamics that dominated the Chinese equity market on 6 February 2026.

Market Context

During the trading day, the Shanghai Composite, Shenzhen Component and ChiNext indices all posted modest gains, with the latter rising by 0.65 %. The rally was propelled largely by the chemical and traditional medicine sectors, both of which experienced widespread buying across dozens of stocks. In the chemical arena, key names such as Dazhou Big Chemical, Jinniu Chemical and Bachuan Shares hit their daily limits, reflecting renewed confidence in the upstream commodity cycle. In parallel, the traditional medicine segment saw a wave of limit‑ups, led by Zhi Yi Pharmaceutical and Hansen Pharma, underscoring the impact of a recent policy announcement.

On 5 February, the Ministry of Industry and Information Technology, together with seven other ministries, issued the “Implementation Plan for High‑Quality Development of the Traditional Chinese Medicine Industry (2026‑2030)”. The plan sets a five‑year target to create an integrated value chain, secure stable supply of key raw materials and accelerate digital and green transformations. The policy lift immediately translated into a market rally, with the traditional medicine index surging and multiple constituents reaching their trading ceilings.

TEYI’s Positioning

TEYI’s core business—production of both traditional Chinese medicine (TCM) and chemical agents—places it squarely within the sectors that benefited from the policy and market lift. The company’s market capitalization of CNY 5.97 billion and a trailing price‑earnings ratio of 65.66 indicate that investors view TEYI as a growth play with high valuation multiples, typical of companies operating in rapidly expanding or heavily subsidised segments.

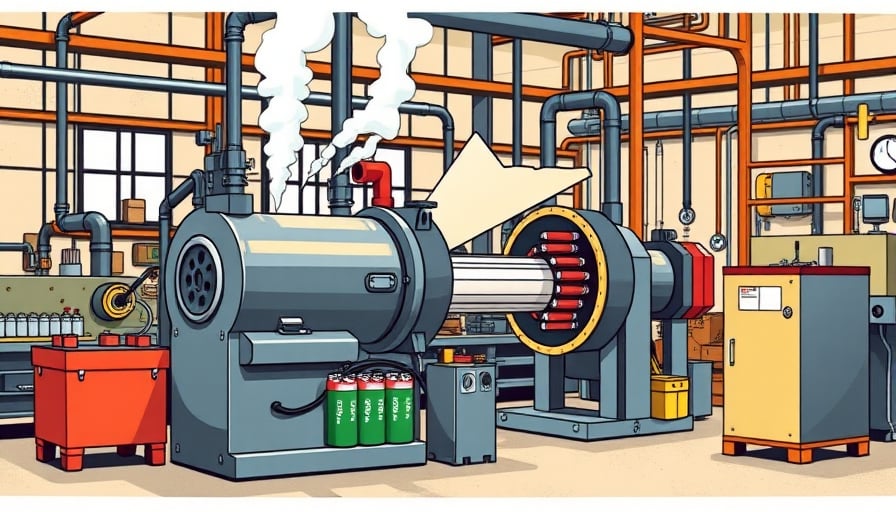

The chemical arm of TEYI aligns with the broader chemical strength observed in the market. With the upstream commodity cycle turning in China’s favor, firms that can convert raw materials into finished products stand to capture margin expansion. TEYI’s production capacity, coupled with its strategic location in Taishan—a region known for pharmaceutical manufacturing—positions it to benefit from the rising demand for chemical intermediates in TCM synthesis.

On the TCM side, the policy’s focus on supply chain stability and technology adoption dovetails with TEYI’s existing capabilities. The company’s emphasis on developing both traditional and chemical agents gives it flexibility to pivot between markets and leverage cross‑supply‑chain efficiencies. Moreover, TEYI’s website (www.tczy.com.cn ) provides a comprehensive portfolio of products, suggesting a diversified revenue base that can withstand commodity price swings.

Forward‑Looking Perspective

Given the dual momentum in both chemical and TCM sectors, TEYI is likely to experience an acceleration in revenue growth in the coming quarters. The company’s ability to scale production, coupled with policy‑backed demand, should translate into higher throughput and potentially improved gross margins. Investors should monitor:

- Production capacity expansion: Any announcements of new manufacturing plants or capacity upgrades would signal an intent to capture growing demand.

- Supply chain integration: Moves toward vertical integration—especially in sourcing raw materials—could mitigate cost volatility and enhance control over quality.

- Technology adoption: Implementation of digital and green technologies, as advocated in the 2026–2030 plan, could reduce operating costs and improve regulatory compliance, thereby strengthening competitive positioning.

Conclusion

TEYI Pharmaceutical Group Co Ltd stands at a strategic crossroads where policy support, market demand, and intrinsic operational strengths converge. The company’s dual focus on traditional Chinese medicine and chemical agents, combined with favorable macro‑economic conditions, positions it to capitalize on the current bullish trajectory of both sectors. As China continues to prioritize high‑quality development in its pharmaceutical and chemical industries, TEYI’s growth prospects appear robust, provided it can effectively navigate execution risks and maintain operational excellence.