UBS: UBTech Robotics Faces a Reality Check While Its Products Promise the Future

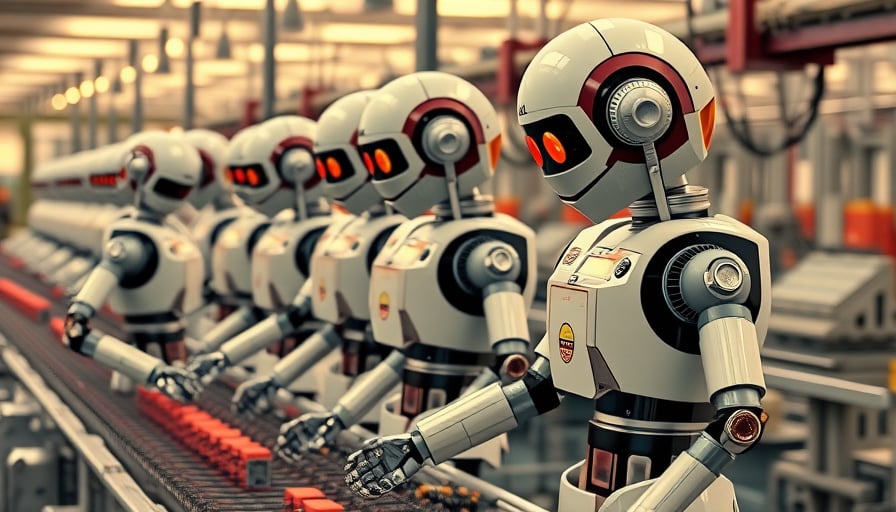

UBTech Robotics Corp Ltd, listed on the Hong Kong Stock Exchange, remains a high‑profile name in China’s robotics boom. Its portfolio—ranging from autonomous delivery vans and industrial forklifts to humanoid teaching assistants and elder‑care companions—has attracted headlines, yet the company’s actual delivery numbers and operational efficiency raise serious doubts about the narrative of imminent mass adoption.

The Numbers Behind the Hype

At a closing price of 15.6 EUR on 22 January 2026, UBTech’s market capitalisation sits at roughly 7.9 billion EUR, a modest figure for a firm whose product catalogue is billed as “full‑stack.” The company’s 52‑week high of 16.8 EUR and low of 11.45 EUR indicate a narrow trading range, signalling limited investor enthusiasm despite the company’s expansive R&D pipeline.

These financial figures should be weighed against the firm’s production data. According to a 24 January 2026 article in Neue Zürcher Zeitung, UBTech has delivered only 500 units of its flagship humanoids since its founding in 2012. The vast majority of these units have been confined to pilot tests in factories and warehouses, never moving beyond the prototype stage. Such numbers starkly contrast with the company’s public claims of “hundreds of thousands of units in deployment worldwide.”

Efficiency Gap: Robots vs. Humans

A 25 January 2026 Financial Times report echoes the sentiment that robots are still only half as efficient as human workers. The piece quotes a UBTech executive who acknowledges the difficulty of replacing human labor with machines, yet the industry’s relentless pursuit of robotic automation continues unabated. This admission is crucial: it underlines a fundamental mismatch between UBTech’s technology and the real‑world constraints of industrial production lines, where reliability, adaptability and cost‑effectiveness are paramount.

The executive’s comment also hints at a strategic dilemma. On one hand, the company is racing to order its own robots to keep up with competitors; on the other, it admits that current models cannot yet deliver the promised productivity gains. This contradiction suggests that UBTech’s growth trajectory may be more about market perception than tangible performance.

Strategic Partnerships and Market Position

UBTech’s recent alignment with Airbus, announced in the same week, underscores a shift toward high‑profile collaborations. Airbus’s decision to employ “squatting” Chinese robots in aircraft assembly—a move facilitated by a UBTech deal—signals a strategic entry into the aerospace sector. However, the partnership’s success remains contingent on the robots’ proven reliability and safety, both of which have yet to be demonstrated on a commercial scale.

Meanwhile, UBTech’s diversified product range—from consumer appliances (vacuum cleaners, lawn mowers) to commercial service robots (delivery, cleaning, healthcare)—suggests an attempt to spread risk across multiple segments. Yet the company’s core strength appears to lie in its humanoid and logistics robots, areas where competition is fierce and the bar for innovation is high.

Investor Implications

Investors looking at UBTech should be cautious. The company’s stock, trading within a narrow band, reflects market uncertainty. While the 52‑week high suggests occasional optimism, the lack of concrete delivery figures and the stark efficiency gap highlighted by the Financial Times raise red flags. Any valuation premised on future deployment of thousands of units must be tempered by the reality that, to date, only a few hundred have seen the light of day.

Moreover, the geopolitical context cannot be ignored. The Business Insider article about Airbus’s warning of new geopolitical risks illustrates the broader volatility that could affect UBTech’s supply chains, especially if its robots are sourced from or manufactured in politically sensitive regions.

Conclusion

UBTech Robotics Corp Ltd is undeniably at the forefront of China’s robotics narrative, boasting a portfolio that spans industrial, commercial, and consumer applications. Yet the disparity between its ambitious product lineup and the modest delivery statistics, coupled with the proven inefficiency of robots compared to human workers, paints a picture of a company still struggling to translate innovation into market reality. For investors and industry observers alike, the message is clear: hype must be matched by hard data, and until UBTech can demonstrate consistent, scalable performance, its growth story remains unproven.