Norfolk Southern Corp: A Potential Industry Giant in the Making

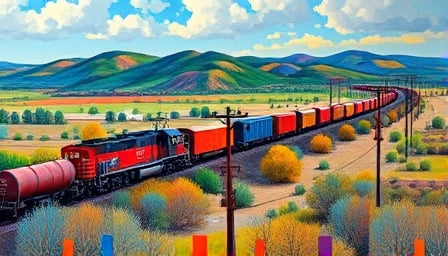

In a significant development for the rail industry, Norfolk Southern Corporation (NSC), a leading industrial transportation company based in Atlanta, is reportedly on the brink of a transformative merger. Known for its extensive rail transportation services across the Southeast, East, and Midwest regions of the United States, Norfolk Southern is now at the center of a potential industry-defining deal.

Union Pacific’s Ambitious Acquisition

Union Pacific Corp. (UNP), the largest U.S. railroad operator, is nearing a stock-and-cash acquisition deal for Norfolk Southern, valuing the latter at approximately $320 per share. This proposed transaction, as reported by Bloomberg and other financial news outlets, would mark the rail industry’s largest-ever tie-up. The deal, which could be finalized as early as next week, would create a transcontinental rail behemoth, reshaping the landscape of ground transportation in the United States.

Strong Financial Performance

Amidst these merger talks, Norfolk Southern has reported robust financial results for the second quarter of 2025. The company announced a revenue of $3.1 billion and a diluted EPS of $3.41, reflecting a 5% year-over-year increase. With an operating ratio of 62.2% and railway operating income of $1.2 billion, Norfolk Southern’s financial health appears solid, potentially making it an attractive acquisition target.

Market Reaction and Future Prospects

As of July 27, 2025, Norfolk Southern’s stock closed at $286.42, slightly below the proposed acquisition price. The market cap stands at $62.67 billion, with a price-to-earnings ratio of 18.99. The potential merger has undoubtedly stirred interest among investors and industry analysts, who are keenly watching how this deal could influence market dynamics and competitive positioning.

Expert Insights

Financial expert Jim Cramer has weighed in on the potential merger, suggesting that the success of this deal hinges on strategic integration and regulatory approval. The merger could lead to enhanced operational efficiencies and expanded service offerings, benefiting both companies and their stakeholders.

As the rail industry anticipates this monumental merger, Norfolk Southern’s future as part of a larger entity could redefine its role in the transportation sector, promising new opportunities and challenges ahead.