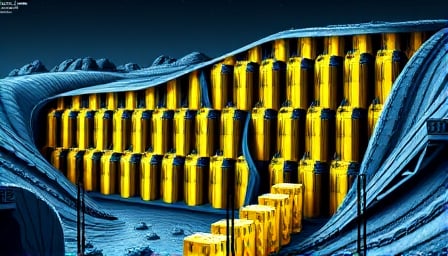

Uranium Royalty Corp: A High-Risk Investment in a Volatile Market

In the ever-fluctuating energy sector, Uranium Royalty Corp stands out as a company that has taken a bold stance by specializing in uranium investments. As of July 14, 2025, the company’s stock closed at 3.41 CAD on the Toronto Stock Exchange, a significant drop from its 52-week high of 4.3 CAD on October 20, 2024. This decline highlights the volatility and inherent risks associated with uranium investments, raising questions about the company’s future prospects.

A Market Cap of 430 Million CAD: Is It Justified?

With a market capitalization of 430 million CAD, Uranium Royalty Corp positions itself as a notable player in the uranium market. However, the company’s price-to-earnings ratio of 386.09 suggests a highly speculative investment. This astronomical ratio indicates that investors are paying a premium for potential future earnings, which may not materialize given the unpredictable nature of uranium prices and geopolitical influences.

Strategic Investments: A Double-Edged Sword

Uranium Royalty Corp’s strategy involves making strategic investments in uranium interests, including royalties, streams, debts, and equity stakes in uranium companies. While this approach allows the company to gain exposure to uranium prices without the operational risks of mining, it also ties its fortunes to the performance of its investments. The recent downturn in uranium prices has put pressure on these investments, raising concerns about the company’s ability to deliver returns to its shareholders.

Navigating a Volatile Market

The uranium market is notoriously volatile, influenced by factors such as global energy policies, nuclear power demand, and geopolitical tensions. Uranium Royalty Corp’s reliance on this market makes it susceptible to these external pressures. Investors must consider whether the company’s strategic investments can withstand such volatility and whether the potential rewards justify the risks.

Conclusion: A High-Stakes Game

Uranium Royalty Corp’s current position in the market is a testament to the high-stakes nature of investing in uranium. With a market cap of 430 million CAD and a price-to-earnings ratio that suggests speculative investment, the company faces significant challenges. Investors must weigh the potential for high returns against the risks of market volatility and geopolitical uncertainties. As the company navigates these turbulent waters, only time will tell if its strategic investments will pay off or if it will succumb to the pressures of the volatile uranium market.