VAT Group AG: A Focus on Precision Vacuum Components

VAT Group AG, listed on the SIX Swiss Exchange under the ticker VAT, operates within the industrial machinery sector. The company specializes in the design, manufacture, and global supply of vacuum valves, multi‑valve modules, and edge‑welded bellows. These precision components are essential for high‑technology manufacturing lines, notably in semiconductor, display, and solar‑panel production.

Market Performance

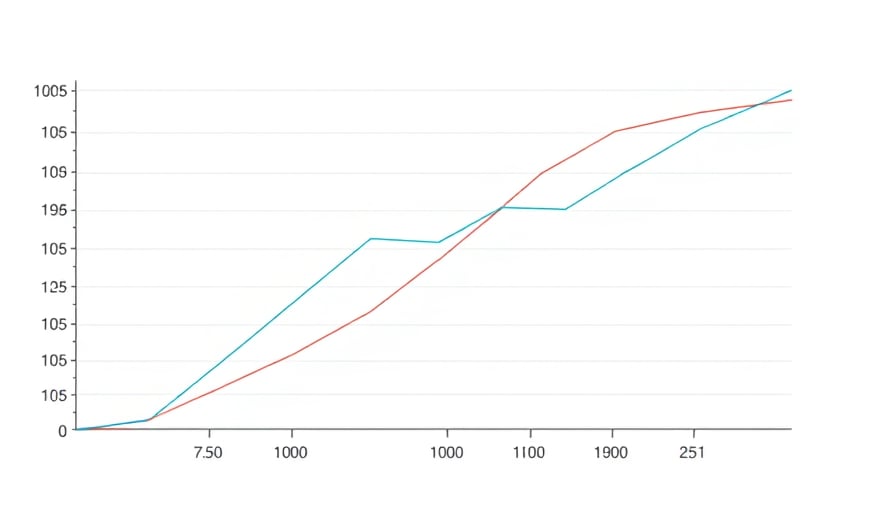

As of 22 January 2026, VAT’s share price stood at CHF 511.20, reflecting a slight dip from its 52‑week peak of CHF 522 reached on 21 January 2026. The 52‑week low, CHF 236.50, was recorded on 6 April 2025, indicating a significant recovery in the last six months. The market capitalization, calculated at CHF 15.15 billion, places VAT among the larger players in the Swiss industrial machinery arena.

The price‑earnings ratio, 67.85, is markedly higher than the industry average, suggesting that investors are pricing in strong growth prospects or that earnings have been under‑performing relative to share price. This valuation metric warrants close monitoring, especially in a context of fluctuating demand for semiconductor and solar manufacturing equipment.

Product Portfolio and Market Position

VAT’s core offerings—vacuum valves and multi‑valve modules—are integral to maintaining the vacuum integrity required in semiconductor fabrication, OLED panel assembly, and photovoltaic cell manufacturing. Edge‑welded bellows, another key product line, provide flexible, high‑pressure containment that is critical in advanced process equipment.

By serving multiple high‑growth industries, VAT benefits from diversified revenue streams. The semiconductor sector’s rapid cycle of innovation and the expanding solar‑energy market both provide robust demand for the company’s components. VAT’s global distribution network further enhances its ability to tap into emerging markets and to mitigate region‑specific risks.

Strategic Considerations

Supply Chain Resilience: The company’s reliance on high‑precision manufacturing underscores the importance of a stable supply chain for raw materials such as specialty metals and polymers. Any disruptions could affect lead times and cost structures.

Technological Advancement: Continuous investment in research and development is essential to keep pace with evolving process requirements in the semiconductor and solar industries. Maintaining a competitive edge in valve design and bellows performance will be critical for sustaining market share.

Capital Allocation: With a high price‑earnings ratio, the market may expect VAT to generate substantial earnings growth or to deploy capital efficiently. Monitoring dividend policy, share buyback plans, and reinvestment in capital expenditure will provide insight into management’s growth strategy.

Outlook

VAT Group AG is positioned at the intersection of several high‑growth technology sectors. Its specialized product range serves industries that are foundational to modern electronics and renewable energy. While the current valuation suggests a bullish market outlook, investors should remain vigilant about the company’s earnings trajectory, capital efficiency, and ability to navigate supply‑chain pressures. Continued observation of VAT’s quarterly financial releases and strategic announcements will be essential to assess whether the market’s premium is justified by future performance.