Vedanta Ltd: Regulatory Cross‑Roads and Shareholder Uncertainty

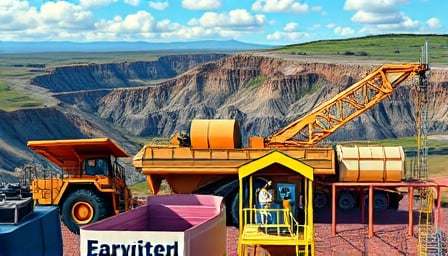

Vedanta Ltd., a prominent player in India’s metals and mining sector, finds itself at a critical juncture. The company’s ambitious de‑merger proposal—aimed at carving out five distinct, publicly listed entities—has been stalled by the Ministry of Petroleum and Natural Gas (MoPNG), which now demands greater transparency around asset valuations, loan structures and potential financial exposure. This latest setback comes on the heels of a flurry of regulatory filings and internal updates that underscore a broader theme: shareholders are being left in the dark as Vedanta wrestles with compliance obligations and strategic realignment.

1. The Demerger Proposal: A Vision in Peril

Vedanta’s de‑merger strategy, spearheaded by chairman Anil Agarwal, intends to separate its core mining operations from ancillary businesses such as oil and gas services. In theory, this restructuring could unlock shareholder value by allowing investors to choose which arm of the conglomerate they wish to back. In practice, however, the Ministry has flagged serious concerns:

- Asset Disclosure: The Ministry alleges that Vedanta has not fully disclosed the true value of its mining assets, particularly in regions with volatile commodity prices.

- Loan Transparency: Questions have arisen around the company’s debt profile, especially the nature and covenants of long‑term borrowings tied to the de‑merger.

- Financial Risk: The proposed split could expose each new entity to higher leverage ratios, potentially jeopardizing credit ratings and investor confidence.

These objections have been presented to the National Company Law Tribunal (NCLT), effectively putting the de‑merger on hold until a comprehensive audit and disclosure exercise can be completed. The delay is likely to erode the anticipated premium that shareholders would have earned from a successful split, and it raises doubts about Vedanta’s governance culture.

2. Shareholder‑Facing Compliance Updates

While the de‑merger debate dominates headlines, several routine yet critical updates have surfaced in the past week, reflecting a company under constant regulatory scrutiny:

| Date | Source | Key Content |

|---|---|---|

| 2025‑09‑17 | NSE India | Intimation for furnishing PAN, KYC details and nomination by security holders in physical mode; announcement of withholding dividend payment. |

| 2025‑09‑17 | BSE India | Same PAN/KYC and dividend withholding notification. |

| 2025‑09‑16 | BSE India | Update on company scheme application (C.A./CAA/MB/220/2024) for Talwandi Sabo Power Limited’s arrangement. |

| 2025‑09‑16 | NSE India | Parallel update on the Talwandi Sabo Power scheme. |

| 2025‑09‑16 | NSE India | Analysts/Institutional Investor Meeting schedule under Regulation 30. |

| 2025‑09‑16 | BSE India | Intimation of Investor Meeting schedule for KINGSINFRA (not Vedanta but illustrates the broader market environment). |

The dividend withholding notice is particularly noteworthy. It signals a possible liquidity constraint or a strategic decision to retain earnings for restructuring costs. Investors should scrutinize whether this withholding aligns with Vedanta’s long‑term profitability trajectory.

3. Talwandi Sabo Power: A Parallel Scheme of Arrangement

Vedanta’s involvement with Talwandi Sabo Power Limited (TSPL) has entered a new phase. Both BSE and NSE filings reference a scheme of arrangement filed under C.A./CAA/MB/220/2024. While the specifics are not disclosed in the brief updates, the mere mention suggests a strategic partnership or acquisition that could alter Vedanta’s asset base. The scheme’s approval status is unclear, but given the timing, it may be intertwined with the company’s broader restructuring narrative.

4. Market Implications and Investor Sentiment

Vedanta’s market cap—₹1.78 trillion—places it among the top-tier Indian mining conglomerates. Its price‑earnings ratio of 12.19 reflects a moderate valuation relative to peers, yet the looming de‑merger uncertainty threatens to compress that ratio further. The stock’s recent close at ₹456.15 sits comfortably below the 52‑week high of ₹526.95 and above the low of ₹363, suggesting that the market is still pricing in potential upside.

However, the combination of regulatory hurdles, dividend withholding, and pending scheme approvals creates an environment of heightened risk. Investors may interpret the Ministry’s objections as a red flag regarding Vedanta’s governance and transparency, which could lead to a sell‑off or a re‑assessment of the company’s future earnings potential.

5. Conclusion

Vedanta Ltd. stands at a crossroads where strategic ambition clashes with regulatory prudence. The de‑merger, a potential catalyst for shareholder value creation, is stalled by credible concerns over asset and debt disclosure. Simultaneously, routine compliance updates and a pending scheme of arrangement with Talwandi Sabo Power add layers of complexity to the company’s operational landscape.

For stakeholders, the message is clear: vigilance is required. The next few weeks will determine whether Vedanta can navigate the regulatory maze and deliver on its restructuring promise, or whether it will settle into a status quo that dilutes shareholder returns. The market’s reaction will hinge on how convincingly the company can address transparency deficits while maintaining growth momentum in its core mining businesses.