Vertex Minerals Limited, an exploration and development company headquartered in Subiaco, Australia, operates within the materials sector. The company is listed on the ASX All Markets and trades in Australian dollars (AUD). As of September 2, 2025, Vertex Minerals’ close price was recorded at 0.275 AUD. Over the past year, the company’s stock has experienced significant volatility, with a 52-week high of 0.36 AUD on February 4, 2025, and a 52-week low of 0.115 AUD on September 9, 2024.

The market capitalization of Vertex Minerals stands at 55,640,000 AUD, reflecting its current valuation in the market. However, the company’s financial performance has been challenging, as indicated by its price-to-earnings (P/E) ratio of -17.369. This negative P/E ratio suggests that the company is currently not generating profits, which is a critical factor for investors to consider.

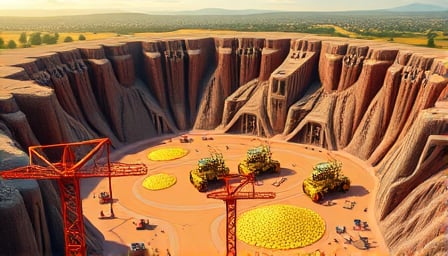

Vertex Minerals Limited primarily focuses on the exploration and development of gold projects. The company’s operations are concentrated within Australia, where it serves its customer base. For those interested in learning more about Vertex Minerals’ activities, initiatives, and future plans, detailed information is available on their official website at www.vertexminerals.com .

The company’s strategic focus on gold projects positions it within a sector that is often influenced by global gold prices and market demand. As such, Vertex Minerals’ performance is closely tied to these external factors, which can impact its exploration and development activities.

In summary, Vertex Minerals Limited is an Australian-based company engaged in the exploration and development of gold projects. Despite its current financial challenges, as reflected in its negative P/E ratio, the company remains active in the materials sector, with a market capitalization of 55,640,000 AUD. For further insights into its operations and strategic direction, stakeholders are encouraged to visit the company’s website.