VusionGroup, a prominent entity in the Information Technology sector, specifically within the Electronic Equipment, Instruments & Components industry, has recently been the subject of market attention. The company is listed on the NYSE Euronext Paris, with its financial activities denominated in euros (EUR).

As of September 16, 2025, VusionGroup’s close price stood at 239.2 EUR. This figure is significant when compared to the company’s 52-week trading range, which has seen the stock price peak at 278 EUR on June 26, 2025, and dip to a low of 131.5 EUR on November 11, 2024. These fluctuations highlight the dynamic nature of the market and the varying investor sentiment towards VusionGroup over the past year.

The company’s market capitalization is currently valued at 3.3 billion EUR, reflecting its substantial presence and influence within its industry. This valuation is a critical indicator of the company’s size and the market’s perception of its future growth potential.

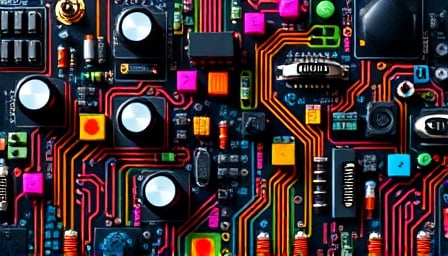

VusionGroup’s operations in the Electronic Equipment, Instruments & Components sector position it as a key player in the development and distribution of advanced technological solutions. The company’s strategic focus on innovation and quality has been pivotal in maintaining its competitive edge in a rapidly evolving industry landscape.

Investors and market analysts continue to monitor VusionGroup closely, given its significant role in the Information Technology sector and its potential for future growth. The company’s performance over the past year, marked by notable highs and lows, underscores the importance of strategic management and adaptability in sustaining long-term success.

In summary, VusionGroup remains a vital entity within its sector, with its financial metrics and market position drawing considerable interest from stakeholders. As the company navigates the challenges and opportunities ahead, its ability to leverage its strengths and address market dynamics will be crucial in shaping its trajectory in the coming years.