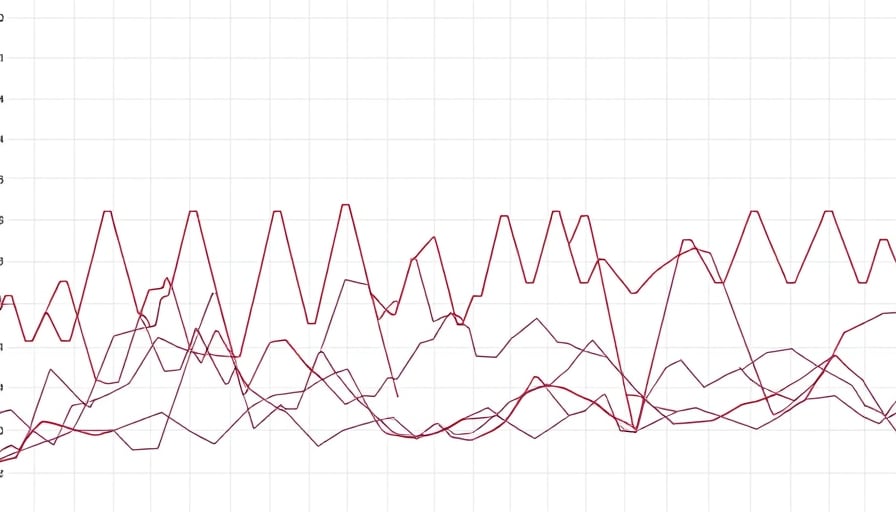

In the ever-evolving landscape of cryptocurrency, Wall Street Bull has emerged as a noteworthy asset, capturing the attention of investors and analysts alike. As of February 12, 2026, the close price of Wall Street Bull stands at $0.00000417308, reflecting a significant point in its market trajectory. This price point is particularly notable as it represents the 52-week low for the asset, a stark contrast to its peak of $0.0000584154 on August 9, 2025.

The journey of Wall Street Bull over the past year has been marked by volatility, a common characteristic of the cryptocurrency market. The asset’s decline from its 52-week high to its current low underscores the challenges and uncertainties inherent in the crypto space. Investors have witnessed a dramatic reduction in value, raising questions about the factors contributing to this downturn.

Several potential influences could be at play in the recent performance of Wall Street Bull. Market sentiment, regulatory developments, and broader economic conditions are all critical factors that can impact cryptocurrency valuations. The decline may also reflect a broader trend within the crypto market, where investors are reassessing their portfolios in light of changing economic indicators and shifting investment strategies.

Despite the current low, Wall Street Bull’s history of reaching a 52-week high suggests that it possesses underlying value and potential for recovery. Investors with a long-term perspective may view the current price as an opportunity to acquire the asset at a discounted rate, anticipating future growth as market conditions stabilize.

The future trajectory of Wall Street Bull will likely depend on several key developments. Regulatory clarity and favorable policy changes could bolster investor confidence, while technological advancements and increased adoption could drive demand. Additionally, macroeconomic factors, such as interest rate movements and inflation trends, will continue to play a significant role in shaping the cryptocurrency landscape.

As Wall Street Bull navigates this challenging period, stakeholders will be closely monitoring market signals and strategic initiatives that could influence its recovery. The asset’s ability to adapt to the dynamic crypto environment will be crucial in determining its long-term success.

In conclusion, while Wall Street Bull currently faces a period of uncertainty, its past performance and inherent potential suggest that it remains a significant player in the cryptocurrency market. Investors and analysts will continue to watch closely, seeking opportunities and insights that could signal a turnaround in its fortunes.