Weichai Power Co. Ltd. – A Case Study in Industrial Momentum

Weichai Power, a heavyweight in China’s machinery sector, has long positioned itself as a pivotal engine of the nation’s infrastructure ambitions. With a market cap exceeding 257 billion HKD, a 52‑week range that underscores volatility yet also growth potential, and a price‑to‑earnings ratio hovering around 19.2, the company sits at a crossroads where policy, demand, and strategic positioning converge.

1. Policy‑Driven Demand: The New Wave of Construction Machinery

The launch of the Engineering Machinery ETF HuaXia (515970) on the Shanghai Stock Exchange is more than a product launch; it signals a broader institutional confidence in China’s heavy‑equipment industry. The ETF’s first‑day volume of nearly one hundred million yuan and a 0.59 % price gain are testament to the market’s appetite for exposure to this sector. Analysts note that the underlying theme index, tracking giants such as Sany Heavy Industry, XCMG, and Weichai Power itself, is heavily weighted (≈70 % in the top ten) toward industry leaders. This concentration is not incidental—it reflects the sector’s “winner‑takes‑most” dynamics, where scale, brand, and technological capability dictate market share.

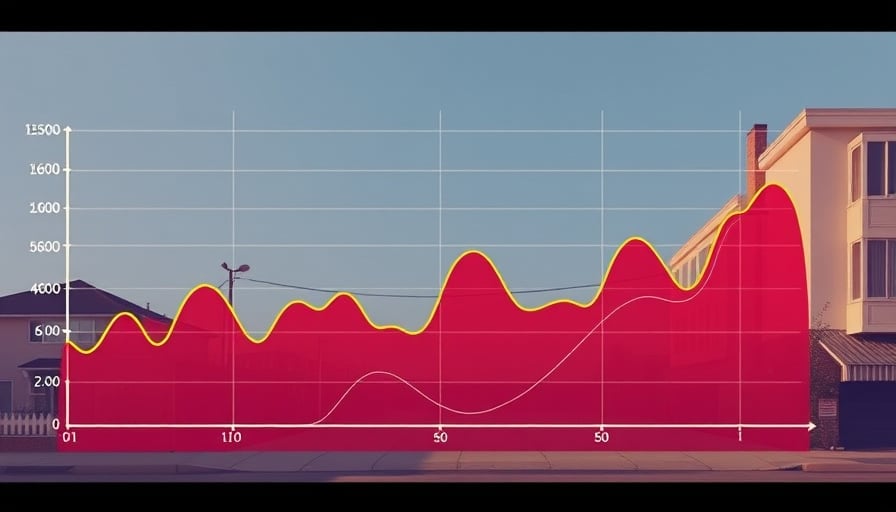

Policy frameworks are reinforcing this narrative. The 2026 Central Document No. 1 outlines accelerated development of high‑end intelligent equipment for hilly and mountainous regions, a strategic push to modernise agriculture and water‑management infrastructure. Simultaneously, the government is funding the construction of 1 billion acres of high‑standard farmlands and upgrading flood‑control systems. Such initiatives create a sustained demand curve for construction machinery, a demand that is set to peak between 2025 and 2028 as the current cycle of machinery depreciation rolls over.

Weichai Power, with its diversified product portfolio spanning engines, heavy vehicles, construction machinery, hydraulic systems, and automotive electronics, is uniquely positioned to capture this upside. Its strong R&D focus and global sales network provide a competitive edge over domestic rivals and overseas challengers.

2. The Engine Behind the Numbers: Weichai’s Financial Pulse

Weichai’s recent closing price of 29.2 HKD (just shy of its 52‑week high) demonstrates a healthy upward trajectory. Its P/E ratio of 19.238, while modest by tech standards, is respectable in a capital‑intensive industry where earnings growth is often slower but more predictable. The company’s market cap underscores investor confidence, and its broad product mix ensures resilience across cyclical swings.

Yet the story is not merely about current valuation. The underlying economics of the machinery sector—long product life cycles, high entry barriers, and strong after‑sales service needs—mean that a company like Weichai can generate stable, repeatable cash flows. As the infrastructure boom continues, these cash flows are likely to expand, providing a cushion for further investment in R&D, expansion, and potential M&A activity.

3. The Competitive Landscape: How Weichai Stacks Up

The Engineering Machinery ETF HuaXia and its counterpart, Engineering Machinery ETF Fuguo (516250), both spotlight Weichai Power among their top holdings. The Fuguo ETF’s 3.6 % intraday rally on February 9th, driven by surges in constituent stocks such as Weichai Power and Weichai Power’s affiliated entities, is a stark reminder of the sector’s volatility and the market’s responsiveness to policy cues.

While competitors like XCMG and Sany dominate the heavy‑equipment segment, Weichai’s strength lies in its integrated supply chain—from engine production to hydraulic components and electronics. This vertical integration is a defensive moat against raw‑material price shocks and a source of higher margins. It also positions the company well to capitalize on the anticipated surge in demand for high‑efficiency, low‑emission engines and smart machinery.

4. Risks and Counterarguments

Critics may point to the sector’s cyclical nature and the potential for an over‑reliance on government spending. The 52‑week low of 13.4 HKD, recorded in April 2025, serves as a reminder that infrastructure projects can stall, leading to reduced orders. Moreover, global competition is intensifying, with foreign manufacturers expanding into China’s market and domestic producers increasing capacity.

However, Weichai’s diversified product lines and international footprint mitigate these risks. Its exposure to both domestic and overseas markets reduces dependency on any single revenue source. Furthermore, the company’s recent strategic moves—such as expanding hydraulic component production in Thailand to serve North American clients—illustrate a proactive approach to diversification.

5. Bottom Line

The confluence of robust policy support, rising demand for construction machinery, and a strong industry position places Weichai Power on an upward trajectory. Its current valuation, while modest compared to high‑growth tech stocks, is justified by the stable earnings profile of the machinery sector and the company’s strategic advantages. Investors who recognize the structural tailwinds of China’s infrastructure and rural modernization agenda will find Weichai Power not merely a passive participant but a front‑line beneficiary.