WUS Printed Circuit Kunshan Co Ltd, a prominent player in the Information Technology sector, has maintained a steady presence in the electronic equipment, instruments, and components industry. Listed on the Shenzhen Stock Exchange, the company has demonstrated resilience and strategic focus in its operations, particularly in the production and sale of double-sided and multilayer circuit boards, as well as connectors for electrical equipment.

As of December 25, 2025, WUS closed at 71.78 CNY, reflecting a moderate yet stable performance. This closing price is part of a broader trend observed throughout the year, where the company’s shares have gradually ascended from a 52-week low of 23.58 CNY in April to a peak of 84.45 CNY in September. This upward trajectory underscores a consistent investor confidence in WUS’s market position and strategic initiatives.

The company’s market capitalization stands at an impressive 138 billion CNY, indicative of its substantial footprint in the industry. With a price-earnings ratio of 40.22, WUS’s valuation is in line with its industry peers, suggesting a balanced approach to growth and profitability. This ratio, while high, is not uncommon in the tech sector, where growth potential often justifies premium valuations.

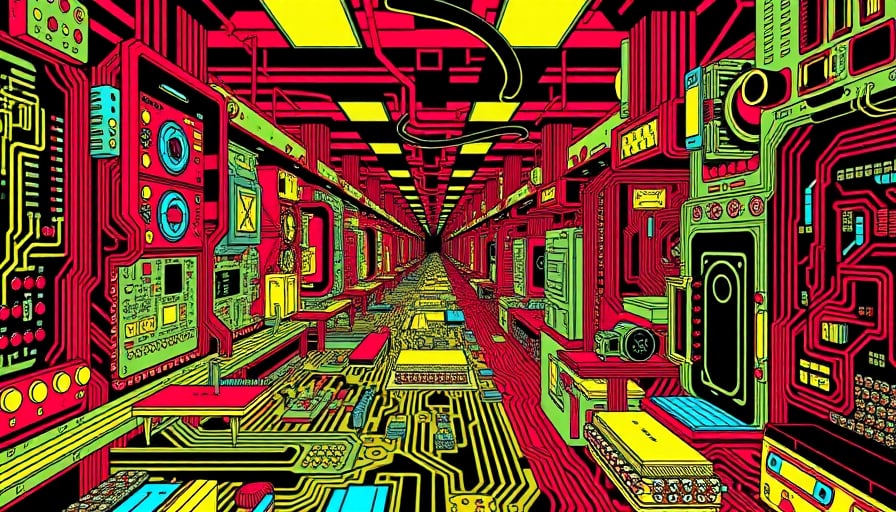

WUS’s product offerings, including double-sided and multilayer circuit boards, are critical components in a wide array of electronic devices, underscoring the company’s importance in the supply chain. The strategic focus on these products highlights WUS’s commitment to innovation and quality, essential factors in maintaining competitive advantage in the fast-evolving tech landscape.

Despite the absence of significant corporate actions or earnings releases in the recent news cycle, WUS’s performance remains consistent with its established market profile. This consistency is a testament to the company’s robust operational strategies and its ability to navigate the complexities of the global electronics market.

In conclusion, WUS Printed Circuit Kunshan Co Ltd continues to solidify its position as a key player in the electronic components sector. With a strong market capitalization, a strategic focus on essential electronic components, and a stable financial performance, WUS is well-positioned to capitalize on future opportunities in the Information Technology industry. As the company moves forward, its ability to innovate and adapt will be crucial in sustaining its growth trajectory and meeting the evolving demands of the global market.