WUS Printed Circuit Kunshan Co Ltd: A Quiet Engine in China’s PCB Landscape

WUS Printed Circuit Kunshan Co Ltd (stock code 002413) continues to grind forward in an industry that is both fiercely competitive and essential to the digital economy. With a market capitalization of 133.65 billion CNY and a price‑earnings ratio hovering at 38.92, the company sits comfortably within Shenzhen’s high‑growth information‑technology sector, yet its valuation still reflects the premium investors place on the rising demand for advanced printed circuit boards (PCBs).

Product Focus and Market Position

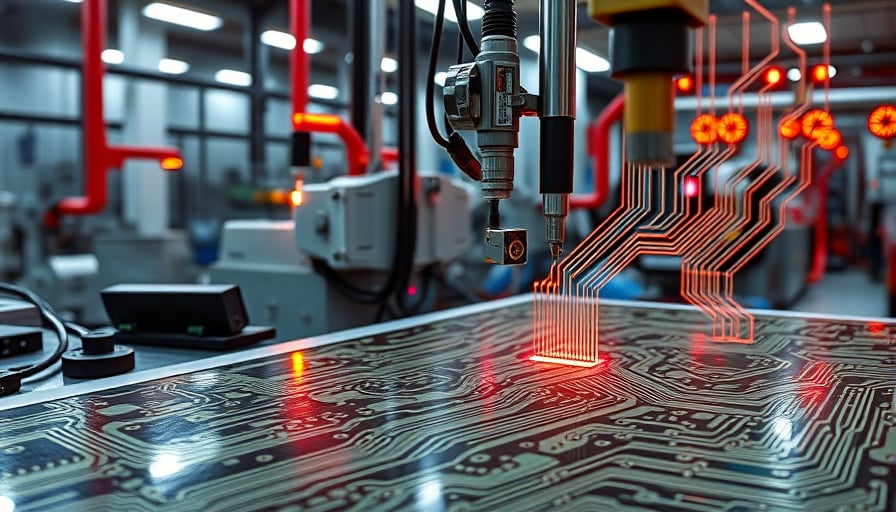

The firm specializes in manufacturing double‑sided and multilayer PCBs, as well as connectors for electrical equipment. These components are the backbone of everything from data‑center servers to automotive infotainment systems. While the company does not yet disclose its full product mix, its catalog—available on www.wuscn.com —reveals a steady stream of high‑frequency, high‑performance boards that cater to the most demanding applications.

Recent Developments in the PCB Arena

The PCB industry has experienced a wave of consolidation and expansion. On November 30, 2025, 沪电股份 (Hui Dian Co., stock code 002463) filed an application to list its H‑shares on the Hong Kong Stock Exchange, with a focus on boosting capacity for high‑performance PCBs. Hui Dian’s plans to invest in CoWoP and next‑generation copper‑in‑foil technology underscore the broader trend toward more complex, high‑density interconnect solutions—an area where WUS has already established a foothold.

In the same month, 股通 activity highlighted a surge of interest in mid‑cap PCB players. Although WUS did not appear on the top of the daily trade list, its inclusion in the Shenzhen Stock Exchange’s “金股” (gold‑stock) recommendations indicates that analysts view the company as a potential “value‑add” pick amid a sector that is attracting institutional capital.

Financial Snapshot

- Closing price (2025‑11‑27): 69.45 CNY

- 52‑week high: 84.45 CNY

- 52‑week low: 23.58 CNY

- Price‑earnings ratio: 38.92

The volatility range between 23.58 and 84.45 over the past year reflects the broader swings in the PCB market, driven by supply‑chain disruptions, raw‑material price hikes, and fluctuating demand from data‑center operators. Nevertheless, WUS’s earnings growth has remained steady, bolstered by its diversified client base in the telecom and automotive sectors.

Strategic Considerations

Capital Expenditure and Capacity Expansion WUS must continue to invest in state‑of‑the‑art manufacturing lines to meet the demands of high‑layer, high‑frequency boards. Failure to do so risks losing market share to rivals such as 沪电股份, which is actively expanding its production footprint.

Technological Upgrades The shift toward through‑silicon vias (TSVs) and copper‑in‑foil (CIF) technologies necessitates significant R&D. WUS’s ability to adopt these innovations quickly will determine its competitive edge.

Supply‑Chain Resilience The COVID‑19 pandemic and geopolitical tensions have exposed vulnerabilities in the supply of critical raw materials like copper and epoxy resin. A robust sourcing strategy is essential to avoid production bottlenecks.

Financial Leverage With a P/E of nearly 39, investors expect WUS to deliver high growth. The company must manage debt levels prudently while allocating sufficient funds for expansion without eroding shareholder value.

Conclusion

WUS Printed Circuit Kunshan Co Ltd is operating in an environment where technological sophistication and capital intensity are the new normal. Its current valuation reflects both the promise of the PCB market and the inherent risks of staying ahead in a rapidly evolving industry. Stakeholders should monitor the firm’s capital‑expenditure plans, technology adoption curve, and supply‑chain resilience to gauge whether WUS will maintain its status as a quiet but pivotal player in China’s electronic equipment landscape.