WUS Printed Circuit Kunshan Co. Ltd. – Company Snapshot

- Listing & Market: Shenzhen Stock Exchange (CNY)

- Sector/Industry: Information Technology → Electronic Equipment, Instruments & Components

- Market Capitalisation: 130 030 000 000 CNY

- Share Price (2025‑11‑09): 67.59 CNY

- 52‑Week Range: 23.58 – 84.45 CNY (high reached 84.45 on 2025‑09‑22)

- P/E Ratio: 37.86

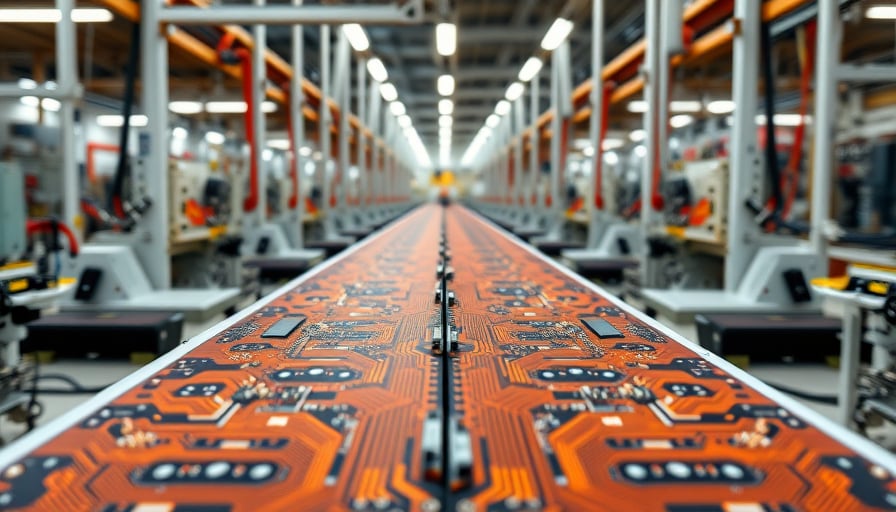

- Business Focus: Manufacture and sale of double‑sided and multi‑layered circuit boards, as well as connectors for electrical equipment.

- Online Presence: www.wuscn.com

- IPO: 18 August 2010

Current Market Context

The A‑share market on 10 November 2025 displayed a mixed but broadly positive trend, buoyed by a rally in the consumer‑goods sector. The Shanghai Composite Index advanced 0.53 % to re‑enter the 4 000‑point zone, while the Shenzhen Component and ChiNext indices saw modest gains. Sector‑wide activity highlighted the resilience of consumer staples, with food & beverage and retail groups registering solid returns.

On the funding side, a net outflow of 163.68 billion CNY was recorded in large‑block trades across the market, yet 47 individual stocks still attracted inflows exceeding 2 billion CNY each. The most significant inflow was directed toward a technology‑focused firm that drew 14 billion CNY, underscoring sustained appetite for growth‑oriented names.

Active equity funds continued to outperform traditional benchmarks, with an average in‑year return of 28.20 % across 8 484 funds, outpacing the Shanghai Composite (19.27 %) and the CSI 300 (18.90 %). Notably, “double‑up” funds—those targeting ≥100 % annual returns—were particularly prolific, with 69 products surpassing the 100 % mark and one achieving 205 % growth.

Outlook for WUS Printed Circuit

Supply‑Chain Positioning WUS Printed Circuit’s core products—double‑sided and multilayered PCBs—are indispensable to the burgeoning semiconductor and electronics ecosystem in China. The continued expansion of domestic chip manufacturing, driven by government incentives and strategic autonomy objectives, is likely to sustain demand for high‑precision circuit boards.

Competitive Landscape Within the Chinese PCB sector, competition is intensifying from both domestic manufacturers and foreign entrants. WUS’s established product portfolio and production capacity provide a competitive moat, yet the firm must monitor cost pressures and technological upgrades (e.g., flexible PCBs, high‑frequency substrates) to maintain market share.

Valuation Considerations The current P/E ratio of 37.86 sits above the broader information‑technology average, reflecting market expectations of continued growth. Investors should weigh the premium against the firm’s growth trajectory and margin stability.

Strategic Initiatives The company’s website indicates ongoing development in connector technology and advanced multilayer boards, positioning it to capture higher‑margin niche markets such as electric vehicles, aerospace, and industrial automation.

Risk Factors

- Cyclical demand: PCBs are closely tied to capital expenditure cycles in electronics and automotive sectors.

- Currency exposure: As a mainland‑listed company, earnings are denominated in CNY; exchange rate swings against the renminbi could compress international revenue.

- Regulatory shifts: China’s industrial policy may redirect funding toward or away from specific semiconductor sub‑segments.

Conclusion

WUS Printed Circuit remains a key player in China’s electronic component supply chain. While its valuation carries a growth premium, the company’s entrenched product base, alignment with national technology priorities, and potential for incremental diversification into high‑margin segments bode well for medium‑term upside. Investors should monitor macro‑economic signals, sector‑specific demand, and the firm’s execution on product innovation to gauge future performance.