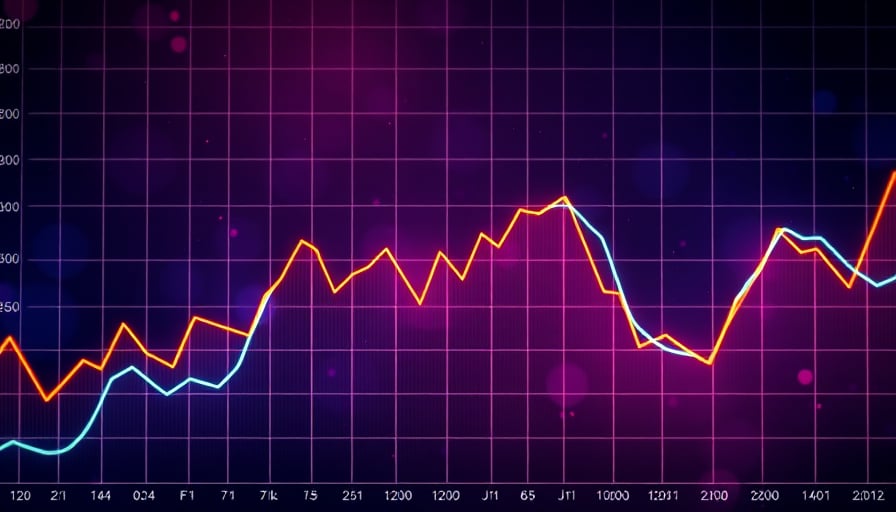

In the ever-evolving landscape of cryptocurrency, Yearn.finance has emerged as a pivotal player, yet its recent performance raises critical questions about its future trajectory. As of December 3, 2025, Yearn.finance’s close price stood at $3,773.84, a stark contrast to its 52-week high of $14,667.1 recorded on December 6, 2024. This significant decline underscores a volatile market environment and highlights the inherent risks associated with crypto investments.

The market capitalization of Yearn.finance, currently at approximately $129.1 million, reflects a diminished valuation from its peak. This reduction in market cap is indicative of broader market sentiments and investor confidence, which have been shaken by the cryptocurrency’s inability to sustain its previous highs. The 52-week low of $3,537.46, reached on December 1, 2025, further emphasizes the downward pressure faced by Yearn.finance, raising concerns about its long-term viability and stability.

Investors and analysts alike must scrutinize the factors contributing to this decline. The volatility of Yearn.finance is not an isolated phenomenon but rather a reflection of the broader cryptocurrency market’s unpredictability. The dramatic fluctuations in price and market cap suggest a need for a more cautious approach to investing in such assets. The potential for high returns is often accompanied by equally high risks, and Yearn.finance’s recent performance serves as a stark reminder of this reality.

Moreover, the decline in Yearn.finance’s valuation raises questions about the sustainability of its business model and its ability to adapt to changing market conditions. As the cryptocurrency landscape continues to evolve, Yearn.finance must demonstrate resilience and innovation to regain investor confidence and stabilize its market position. The challenges it faces are not merely financial but also strategic, requiring a reevaluation of its approach to risk management and market engagement.

In conclusion, the trajectory of Yearn.finance over the past year highlights the precarious nature of cryptocurrency investments. While the potential for substantial gains exists, the risks are equally significant. Investors must remain vigilant, conducting thorough due diligence and maintaining a diversified portfolio to mitigate potential losses. As Yearn.finance navigates this turbulent period, its ability to adapt and innovate will be crucial in determining its future success or failure in the competitive cryptocurrency market.