Yunnan Copper Co., Ltd. (YCC), a prominent materials company listed on the Shenzhen Stock Exchange, recently experienced a notable decline in its stock value, aligning with a broader downturn in the Chinese industrial metals sector. This event unfolded on January 30, 2026, amidst a challenging market environment characterized by falling commodity prices and tightened liquidity.

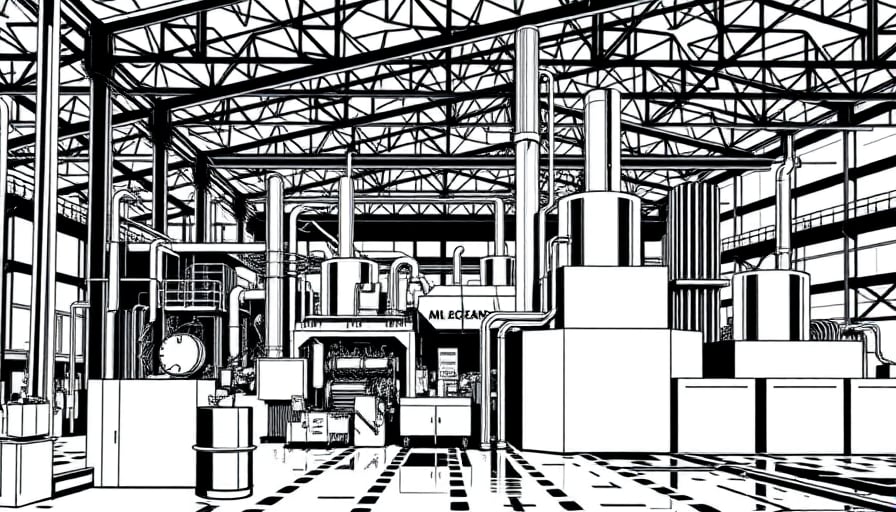

YCC, headquartered in Kumming, China, specializes in the production and processing of electrolytic copper, offering a diverse product range that includes tough cathode, copper wire base, gold, silver, sulfuric acid, and other byproducts. The company’s market capitalization stands at approximately 38.67 billion CNY, with a price-to-earnings ratio of 29.89.

The decline in YCC’s stock value was part of a larger sell-off affecting the entire industrial metals sector. This downturn was influenced by several factors, including a drop in commodity prices and a tightening of market liquidity. The latter was partly triggered by a high-profile technology earnings announcement, which shifted investor focus and reduced institutional buying activity within the metals sector. Consequently, several key copper and silver producers, including YCC, witnessed significant outflows.

Despite the immediate impact on stock prices, analysts maintain a positive outlook for the long-term prospects of industrial metals. They highlight sustained demand for copper, driven by its critical role in emerging technologies and ongoing supply constraints. These factors are expected to support copper prices over time, suggesting that the current dip may be a temporary setback rather than a long-term trend.

YCC’s shares mirrored the broader market movement, reflecting the sector-wide downturn. However, the company’s strong fundamentals and strategic position in the copper market continue to underpin its potential for recovery and growth. As the market stabilizes, YCC’s focus on innovation and efficiency in copper production may well position it to capitalize on future opportunities in the industrial metals landscape.