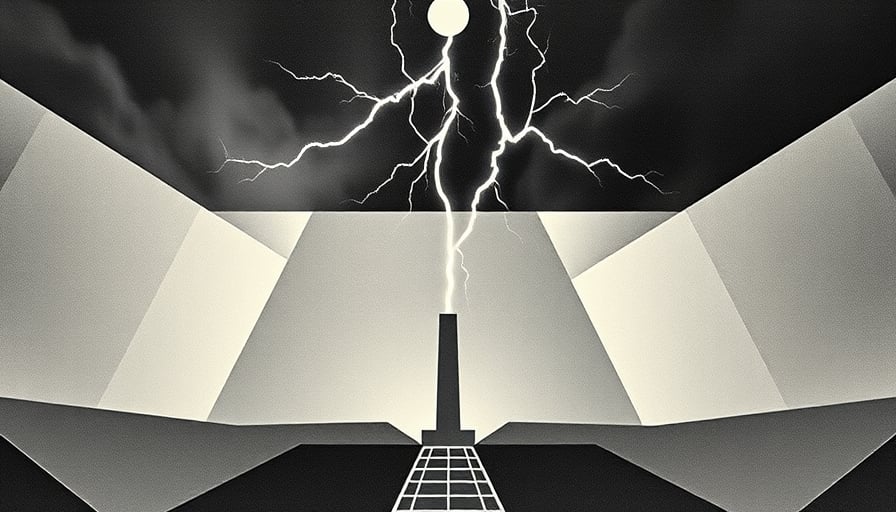

ZG Lightning Protect, officially known as Sichuan Zhongguang Lightning Protection Technologies Co., Ltd., has been a prominent player in the electrical equipment sector, focusing on the development and provision of electromagnetic protection and control systems. These systems are crucial for shielding electrical infrastructures from the potentially devastating effects of lightning strikes. The company operates within the industrials sector and is listed on the Shenzhen Stock Exchange, with its financials denominated in Chinese Yuan (CNY).

As of January 22, 2026, ZG Lightning Protect’s stock closed at 16.51 CNY. This figure is part of a broader financial narrative for the company, which has seen its stock price fluctuate significantly over the past year. The 52-week high was recorded at 19.99 CNY on January 11, 2026, while the 52-week low was 5.87 CNY on April 8, 2025. These fluctuations reflect the dynamic nature of the market and the varying investor confidence in the company’s growth prospects and market position.

The company’s market capitalization stands at 5.38 billion CNY, indicating its substantial size and influence within the industry. However, the price-to-earnings (P/E) ratio of 209.92 suggests that the stock is trading at a premium relative to its earnings, which could be indicative of high investor expectations for future growth or a reflection of the company’s strategic importance in the sector.

ZG Lightning Protect’s core business revolves around the provision of advanced electromagnetic protection and control systems. These systems are designed to mitigate the risks associated with lightning strikes, which can cause significant damage to electrical systems and infrastructure. The company’s technology is essential for a wide range of applications, including telecommunications, power generation, and distribution networks, where the integrity of electrical systems is paramount.

The company’s strategic focus on electromagnetic protection aligns with the growing global emphasis on infrastructure resilience and the need to safeguard critical systems against natural and man-made disruptions. As such, ZG Lightning Protect is well-positioned to capitalize on the increasing demand for its specialized products and services.

In summary, ZG Lightning Protect remains a key player in the electrical equipment industry, with a strong focus on providing solutions that protect against lightning damage. Its financial performance, as reflected in its stock price and market capitalization, underscores its significance in the market. The company’s high P/E ratio may suggest optimistic future growth expectations, while its specialized product offerings continue to be in demand as the world increasingly prioritizes the protection of critical infrastructure.